Stay current on the latest trends in food and agriculture

Count on Foodbytes for trend forecasting, sector-specific outlooks and in-depth industry reports on key themes and innovations shaping the F&A landscape. Learn more from the Foodbytes experts in the Outlooks (free for all hub users) and Reports (Premium users only).

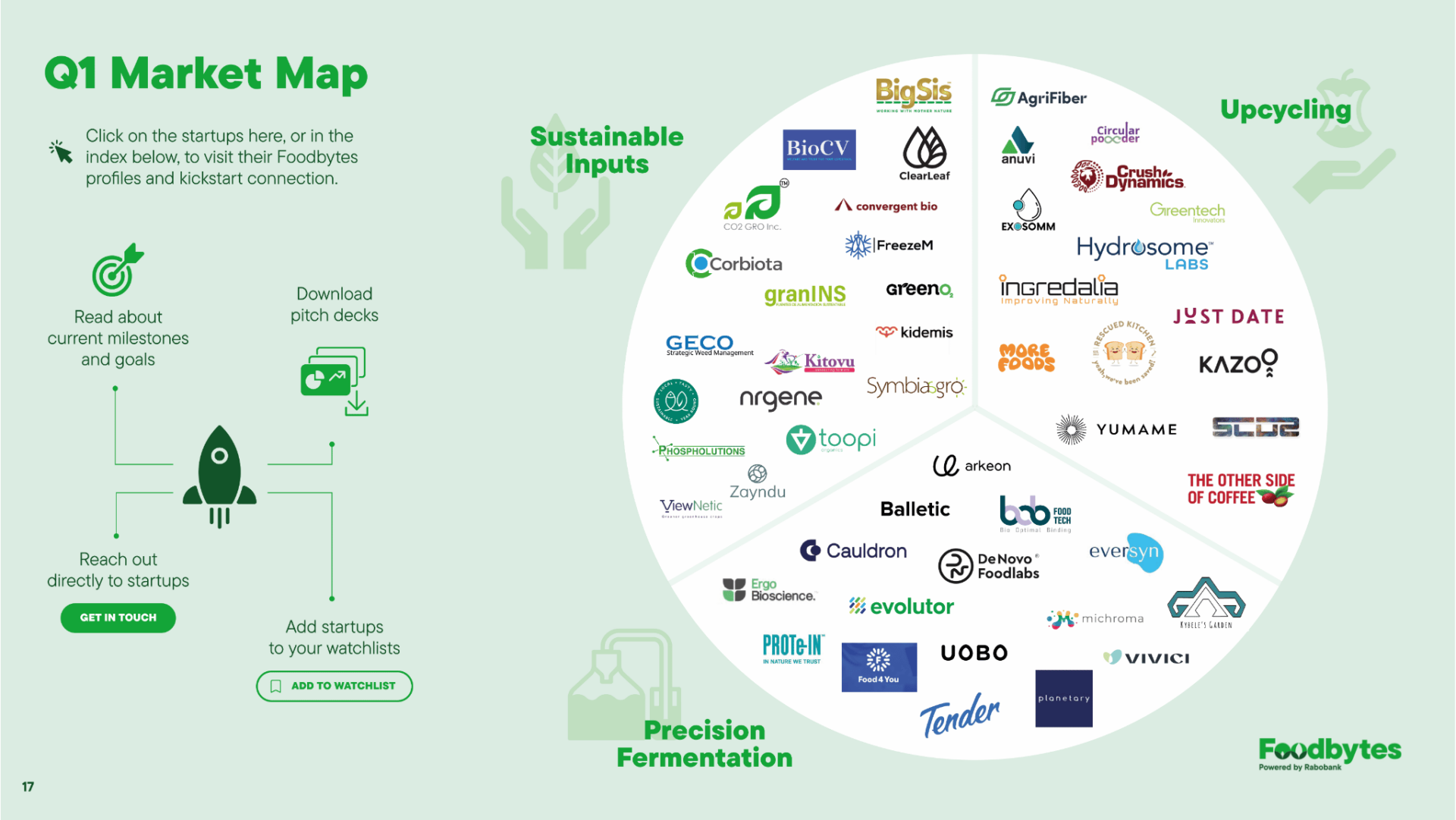

Q1 Report + Market Map: Resilient Practices Powering Near-Term ROI

Sustainable innovations are enhancing efficiency and profits across upstream inputs, midstream upcycling and downstream precision fermentation. Explore proprietary hub insights, collaboration stories and our market map of 50+ startups.

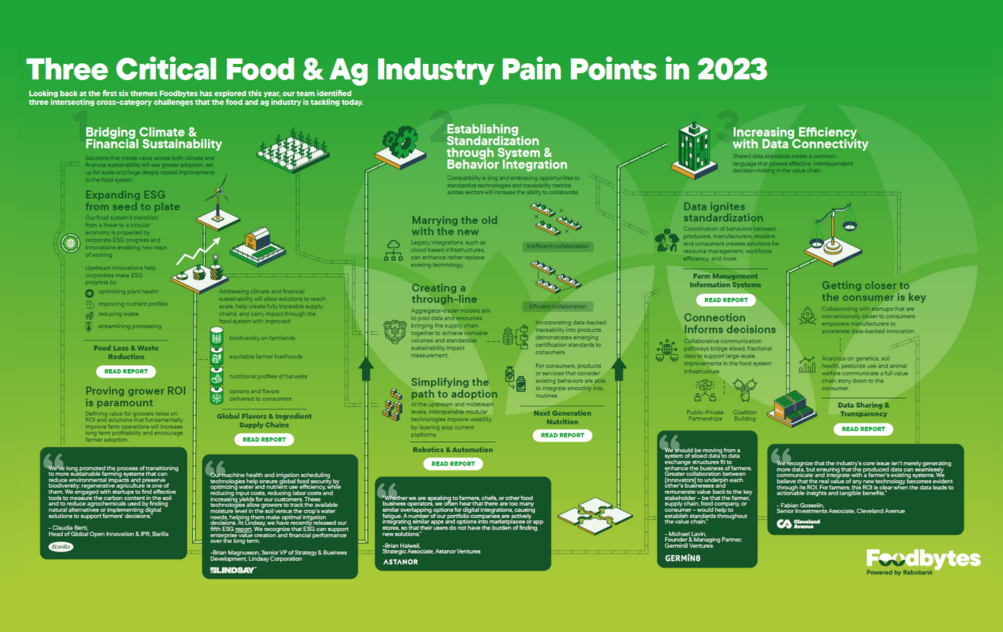

Insights Spotlight: Three Critical Food & Ag Industry Pain Points

Looking back at our Premium reports of 2023, we identified three intersecting challenge areas and explored the value chain story they tell. Plus: exclusive insights from five of our Premium subscribers.

Innovation Themes

Foodbytes fosters connections within the F&A industry that drive meaningful improvement in the food value chain. Throughout the year, we explore themes critical to F&A innovation and sustainability. We align topics with scouting efforts for the Foodbytes hub and incorporate industry insights gleaned from key events.

Our Expertise

Foodbytes publications are rooted in Rabobank’s specialized F&A knowledge and extensive global network. In developing our thematic overviews and in-depth reports, we tap into the expertise of renowned RaboResearch strategists, sector and investment banking colleagues, and those leading sustainable initiatives within Rabobank. Together, these perspectives amplify the robust innovation background and startup know-how of the Foodbytes team.