Scaling Innovation Through Strategic Financing: The TRIC Robotics–CSC Leasing Story

In a market where agriculture is increasingly resource constrained, TRIC Robotics is breaking barriers, expanding productivity, mitigating pest problems, and maintaining plant health. Yet advanced robotics come with hefty upfront costs. That is where CSC Leasing, in collaboration with Foodbytes, steps in, offering precision financing to accelerate innovation in the field.

Doubling the Fleet and Investor Confidence

TRIC, a service-driven ag tech innovator, successfully doubled its robot fleet within a single year, thanks to CSC’s strategic and flexible equipment financing. This expansion not only increased operational capacity and bolstered customer confidence but also played a pivotal role in enhancing TRIC’s fundraising credibility with investors, signalling strong market traction and scalable potential.

“CSC made it possible to double our robot fleet in just one year—boosting capacity, building customer confidence, and helping us keep up with demand.”

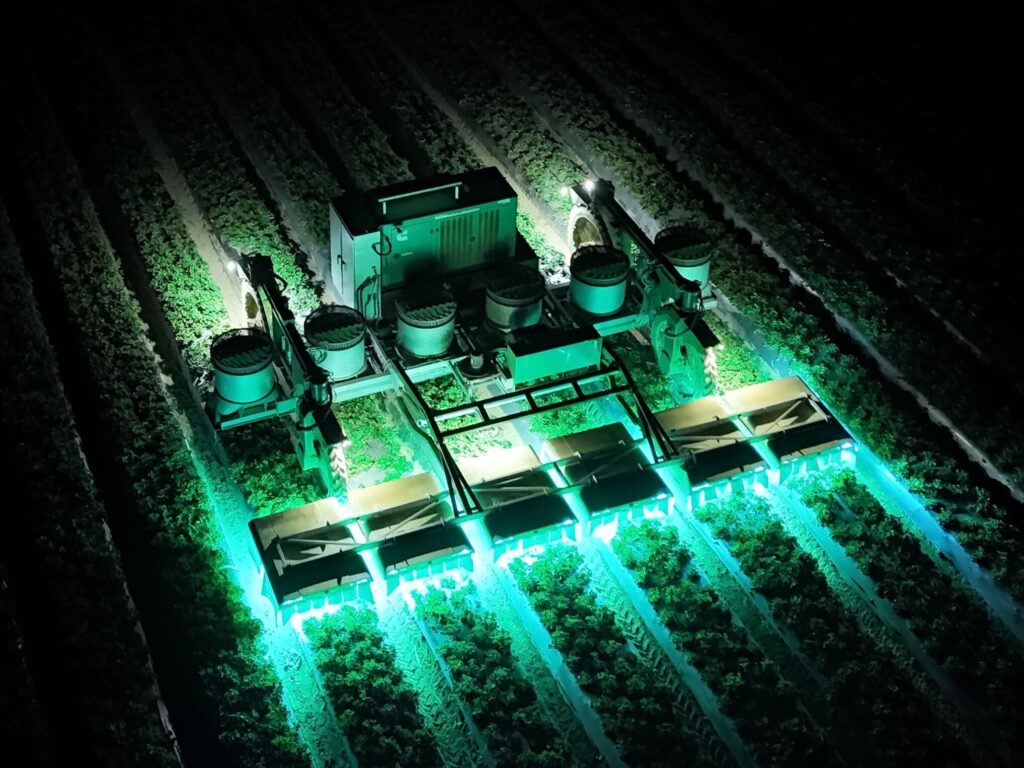

CSC contributed significantly to this growth by deploying $600K in capital expenditure financing for TRIC’s autonomous UV light tractors currently operating in California’s Salinas Valley, with an additional $600K anticipated by the end of the year. This financial backing enabled TRIC to adopt a Hardware as a Service (HaaS) model. The HaaS approach lowers the initial financial barriers for growers, making it easier for them to adopt the technology and accelerating TRIC’s commercial deployment. In addition to HaaS programs, CSC provides flexible solutions such as direct vendor procurement and sale leasebacks that support both HaaS and internal CAPEX projects. These options give founders stage-appropriate ways to stay asset-light, extend runway, and focus equity on innovation and market expansion.

Proven impact in the field

In field trials, TRIC’s UV-C treatments demonstrated their efficacy by reducing mite pressure by 33 percent compared to chemical pesticides. This resulted in visibly healthier plants. As Anthony Reade of Betteravia Farms observes, “After three seasons with TRIC, I feel strongly that the preventative action provided by UV-C, as well as the reduction in the use of pesticides, leads to a healthier and hardier plant that can better withstand the elements.”

From CSC’s perspective, TRIC emerged from its pilot phase with notable financial health, supported by institutional investors and a firm grip on cost management. This made them an ideal candidate for non dilutive hardware financing. CSC recognised that TRIC did not just need funding, they needed flexibility and room to scale. This stage-aligned approach is core to CSC’s model, working with startups from pilot programs through commercial expansion to structure financing that fuels growth while driving capital efficiency.

Practical Advice for AgTech Entrepreneurs

TRIC encourages fellow founders to focus on solving real-world challenges that growers are actively paying to address. Ensure your business model is economically sound so each investment directly translates to cash flow. Engage with lenders early, even before you need capital, to build trust and share your growth vision. When seeking funding, strengthen your case with tangible customer commitments, such as signed contracts or letters of intent.

CSC adds: consider securing debt financing immediately after a successful equity round, not when capital is running low. Planning ahead gives you more flexibility and helps preserve equity for core growth areas.

The TRIC and CSC partnership exemplifies how imaginative capital structures can spur rapid technological deployment in ag tech. With financing matched to real-world field needs, TRIC is not just scaling robots, it is reshaping modern agriculture benefit by grower benefit.

Explore TRIC Robotics’ profile on Foodbytes to dive deeper into their technology and impact. For partnership or financing inquiries, contact Managing Director, Originations, Pem Hutchinson at phutchinson@cscleasing.com.

This content is sponsored by CSC Leasing and reflects their views. It does not necessarily represent the views of Foodbytes or Rabobank.